The New Brunswick Childcare Assistance Program, like many government assistance programs, requires applicants to demonstrate their financial situation to determine eligibility and the level of subsidy for which they qualify. The subsidy amount is specifically based on your household's total gross income before any deductions.

The following are examples of acceptable forms of documentation to establish your household income.

The Canada Revenue Agency (CRA) can provide you with a Proof of Income Statement, which is a simple generic version of your tax assessment. This document summarizes your income and deductions for a specific tax year.

How to get a copy of your Proof of Income Statement:

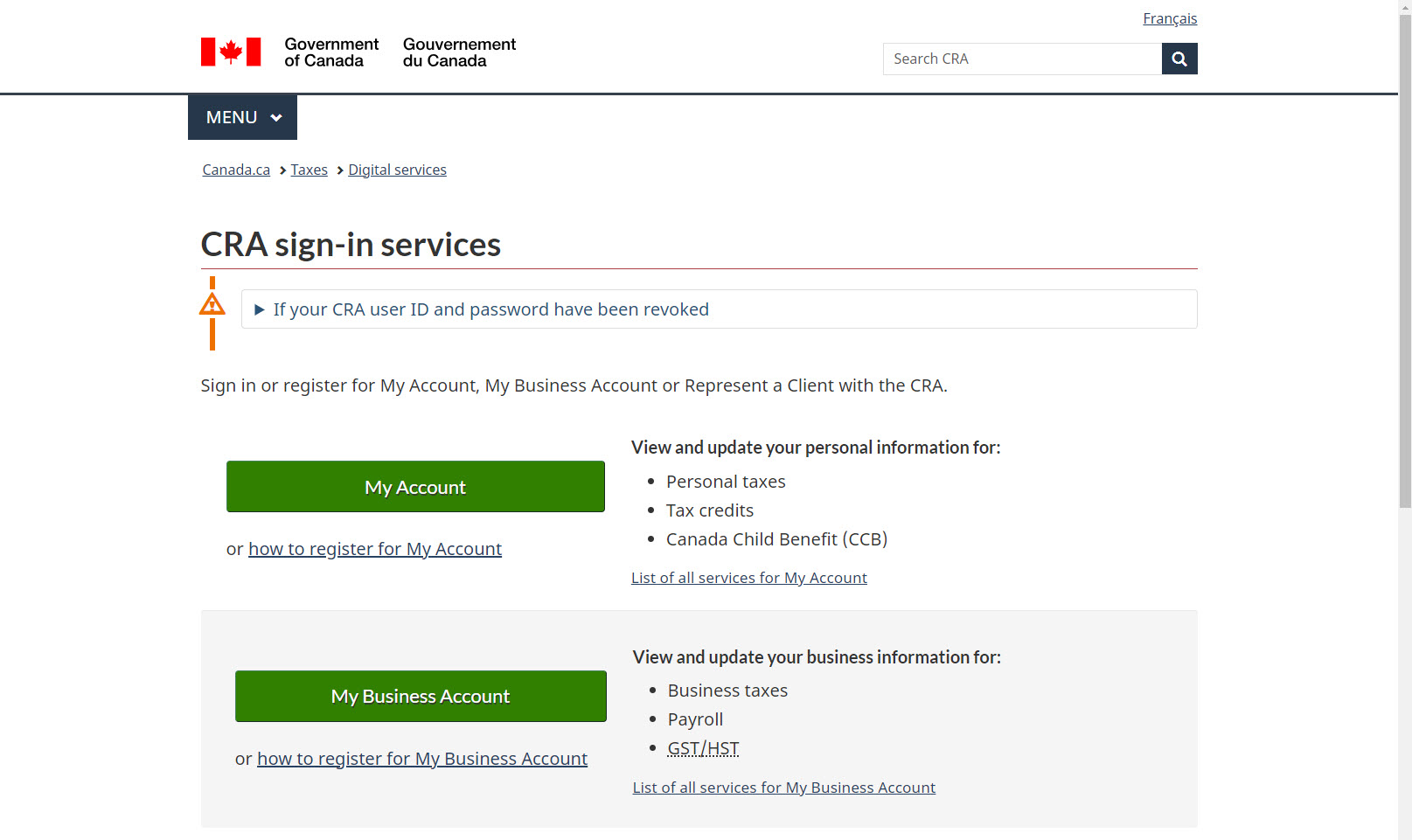

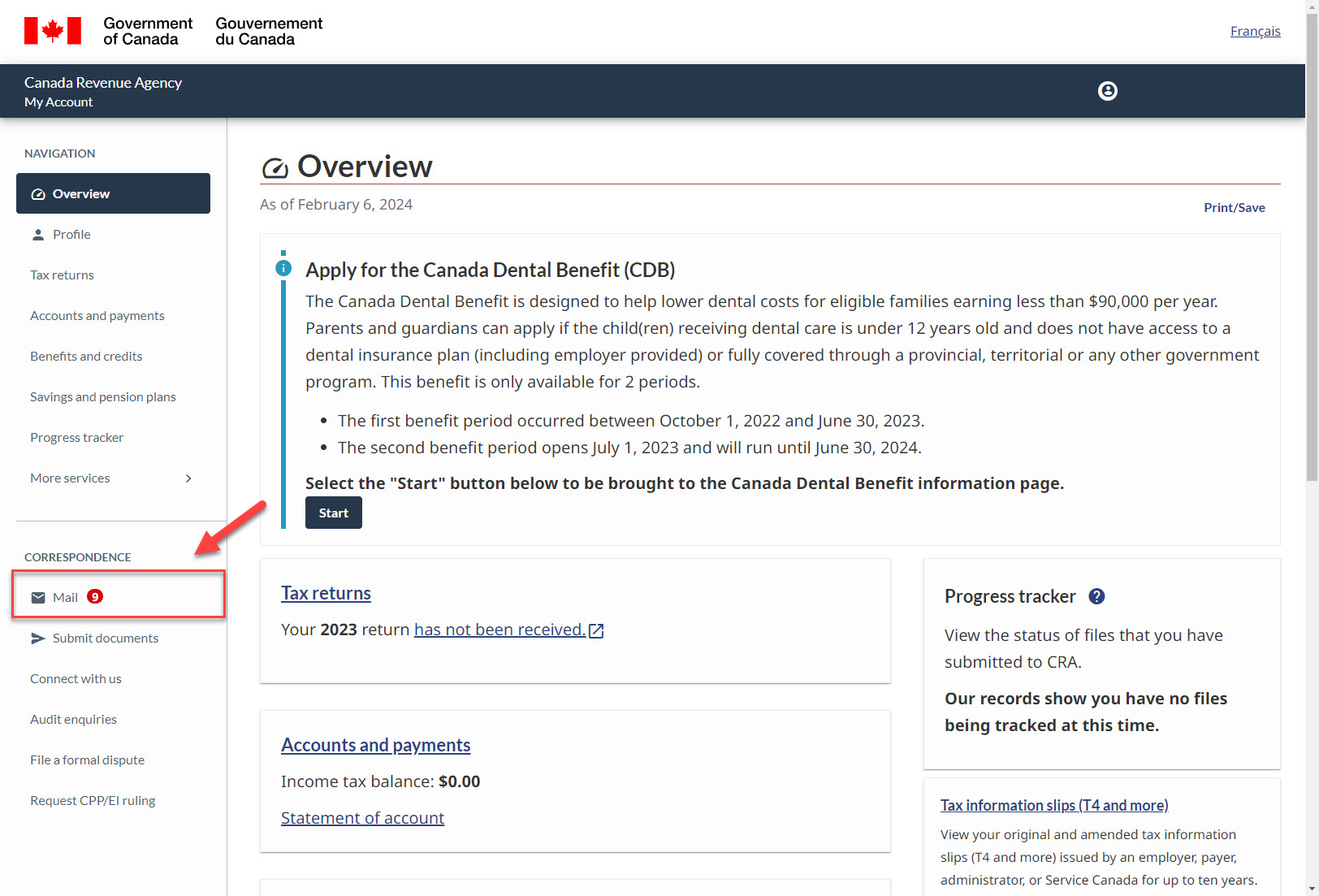

The CRA My Account is an online service provided by the Canada Revenue Agency (CRA) that allows Canadian taxpayers to access their personal or business tax information securely over the Internet.

To use CRA My Account, individuals need to register for the service on the CRA website. Registration involves verifying your identity with specific personal information and creating a secure login using a CRA user ID and password or by using a Sign-In Partner (such as a bank).

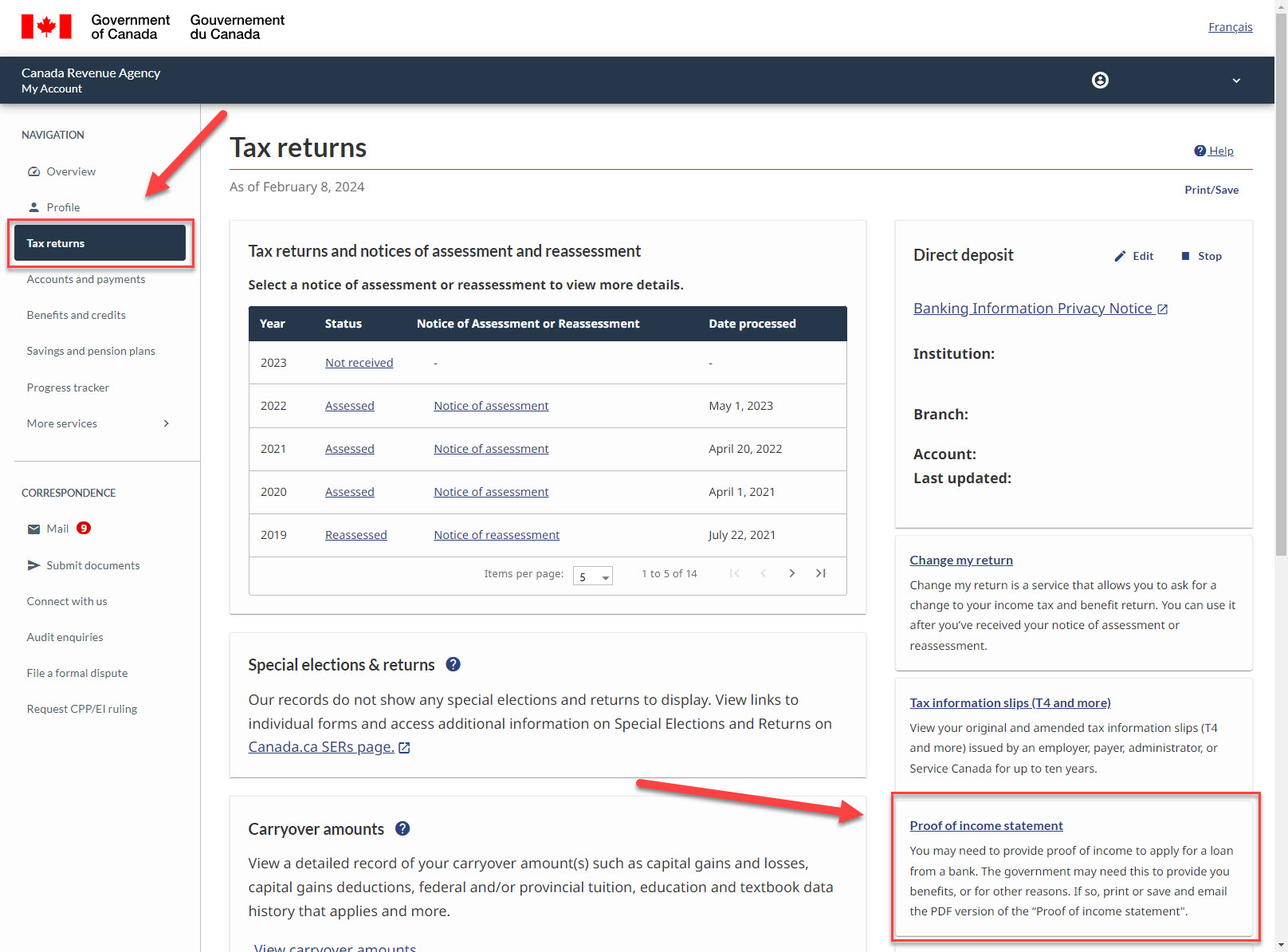

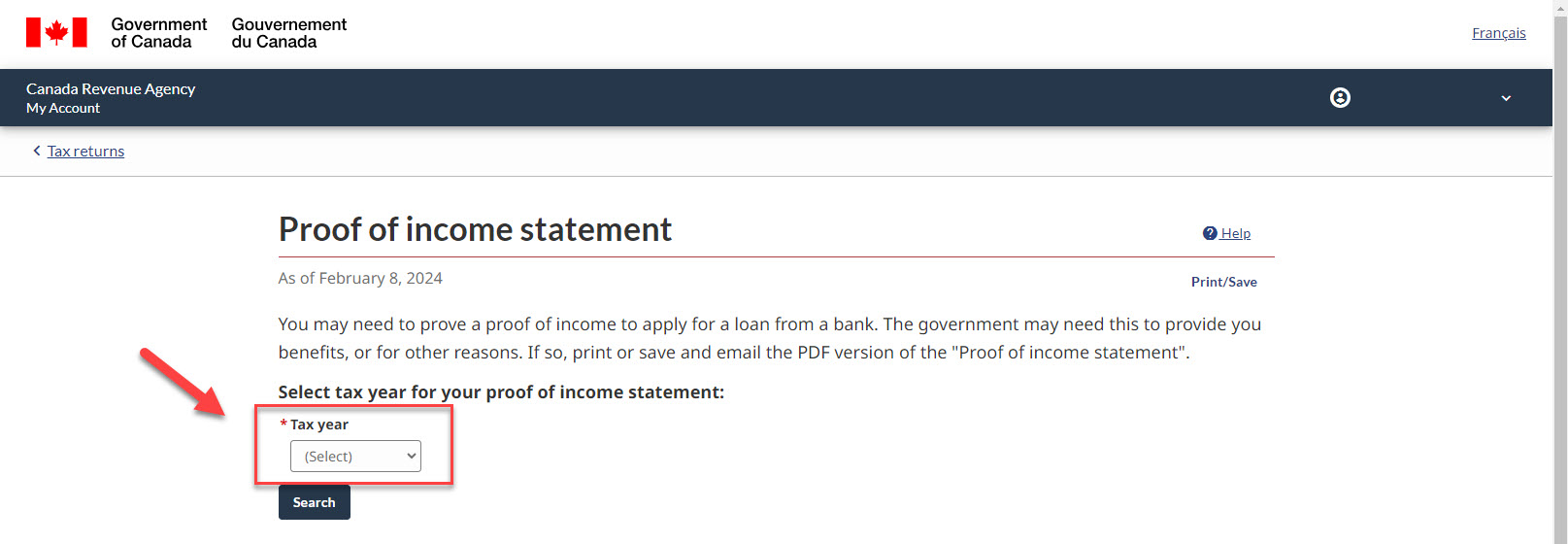

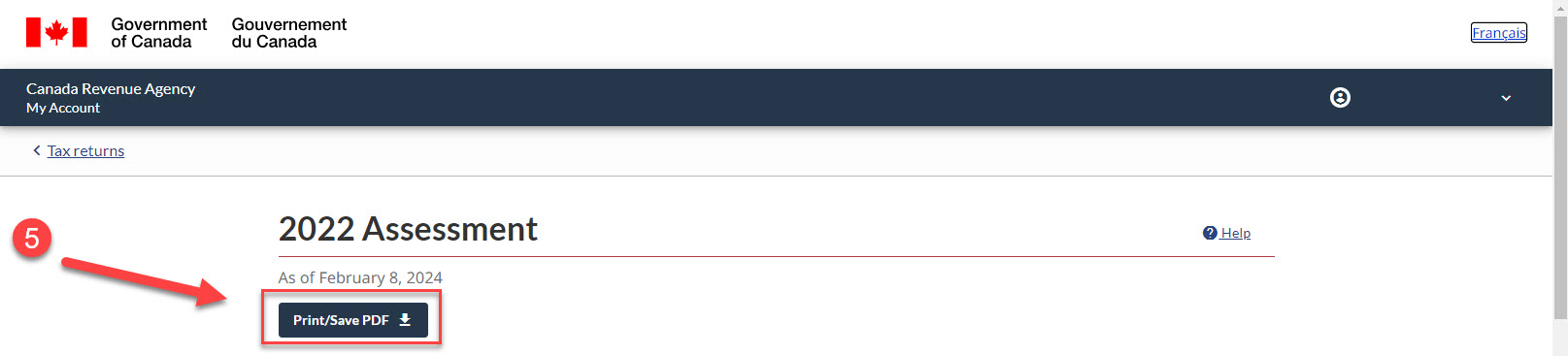

You can view and print your statement in the CRA’s My Account by selecting Proof of Income Statement from the Tax returns page.

Order a copy of a proof of income statement to be mailed to you. It can take up to 10 days to receive by mail. Call CRA’s automated line to get a Proof of Income Statement mailed to you.

Before you call, to verify your identity, you'll need:

If you are calling the CRA on behalf of someone else, you must be an authorized representative.

Telephone number: 1-800-267-6999

Hours: Always open (automated line)

Your Notice of Assessment is the annual statement of your tax return that the Canada Revenue Agency sends you every year after you file your tax return.

There are two ways to get your Notice of Assessment:

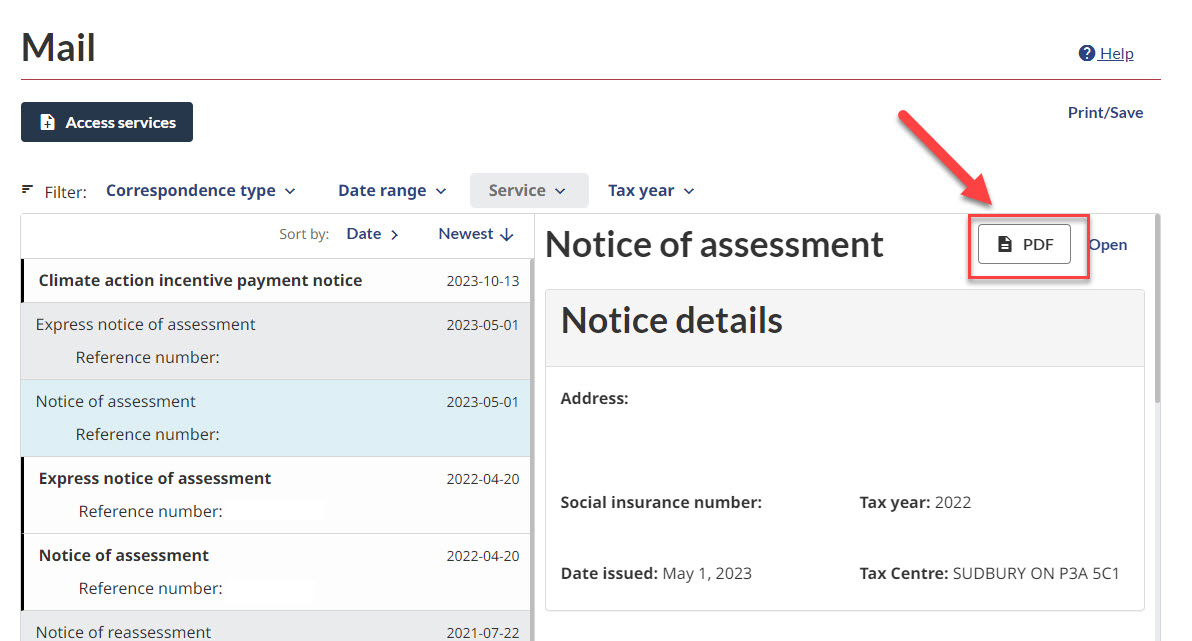

The CRA My Account is an online service provided by the Canada Revenue Agency (CRA) that allows Canadian taxpayers to access their personal or business tax information securely over the Internet.

To use CRA My Account, individuals need to register for the service on the CRA website. Registration involves verifying your identity with specific personal information and creating a secure login account using a CRA user ID and password or by using a Sign-In Partner (such as a bank).

How to get a copy of your Notice of Assessment:

The Canada Revenue Agency (CRA) sends it to the mailing address on your tax return.

Before you call, to verify your identity, you'll need:

If you are calling the CRA on behalf of someone else, you must be an authorized representative.

Telephone number: 1-800-959-8281

Hours: Mon to Fri - 8 am to 8 pm, Sat - 9 am to 5 pm, Sun and Holidays – Closed

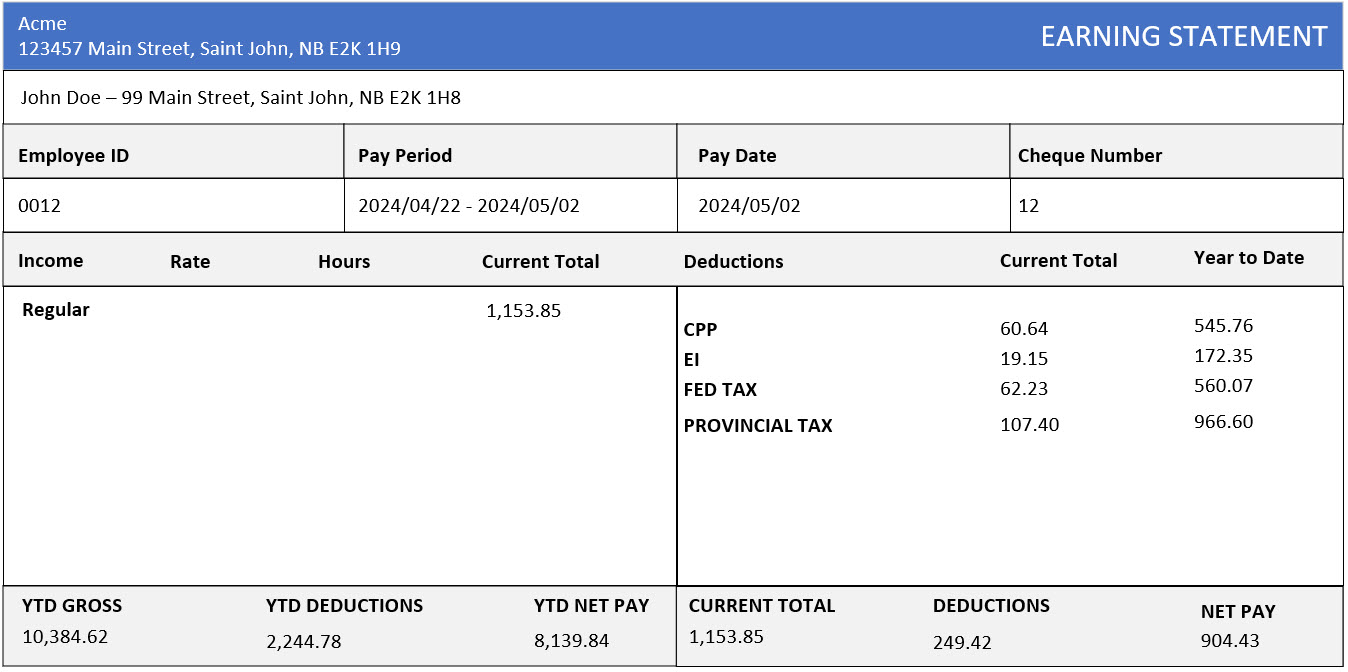

An option for establishing your household income is to provide copies of your four most recent latest pay stubs. Employer pay stubs (also known as earnings statements) are documents provided to employees each time they are paid, detailing the breakdown of their earnings for the pay period, along with deductions such as taxes, insurance, and retirement contributions. Pay stubs should include information such as your gross pay (before deductions), net pay (after deductions), the pay period dates, year-to-date earnings, and details of current and year-to-date deductions.

The example below illustrates a typical paystub that includes the information that EECD needs to determine your benefits.

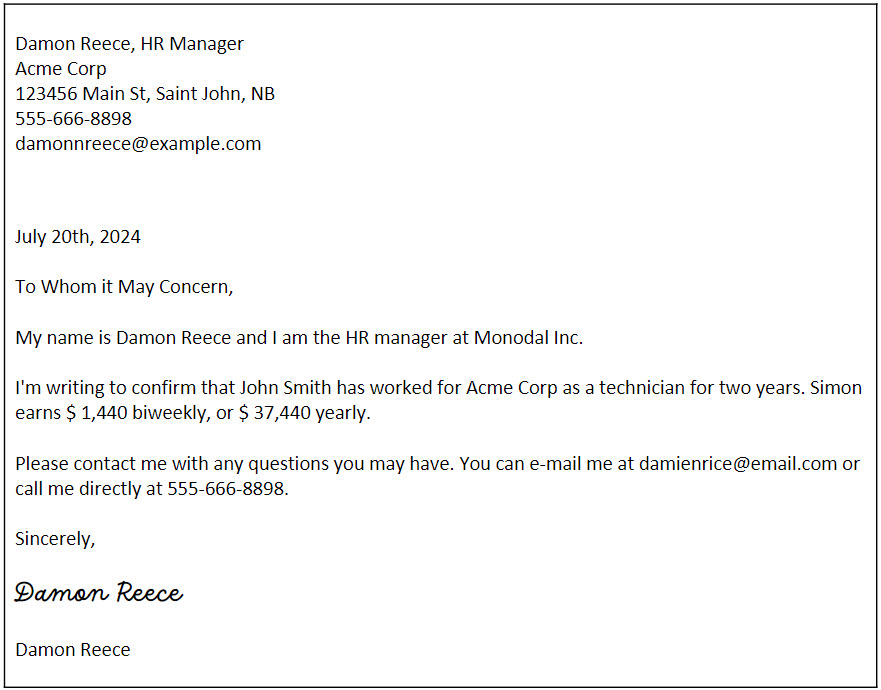

A Proof of Income letter serves as an official confirmation of your current salary by your employer. It demonstrates that you regularly earn a particular amount of money over a certain period. You can typically request an income verification letter from your employer.

The letter should include the following information:

The following is an example of an Income Verification Letter from an Employer:

Self-employed individuals will need to submit documentation showing your registered business number. This unique 15-digit number is assigned by the Province of New Brunswick in conjunction with CRA to registered businesses.

Self-employed individuals in their first year of business can submit a monthly financial statement for up to 3 months’ worth of business operations as Proof of Income. The financial statement must be an accurate depiction of the business’s monthly transactions, showing income and expenses.

Individuals with businesses one year and older should submit a Notice of Assessment or income tax documents for the latest fiscal year.

The gig economy generally refers to services provided through short-term contracts, freelance work, or other temporary work that is arranged through an online platform or mobile application.

In the gig economy, gig workers operate as independent contractors and freelancers. Common platforms used in the gig economy may include, but are not limited to:

If you work for Instacart, you can get a Proof of Employment letter by requesting it at verifications@instacart.com. The letter provided should state your name, employer, and start date. It will also shows your last pay / pay date.

If you work for Skip the dishes, you can sign in to your SkipTheDishes Courier Portal (https://courier.skipthedishes.com/login), then click on earnings history. That brings you to an area that shows your name, employer name, and latest earning period / pay date.

If you work for DoorDash, you can request Proof Of Employment at Dasher Support (https://help.doordash.com/dashers/s/dasher-support).

Contracted services can range from a micro-task (a small task set up through the Internet) to specialized services. Contracted services can include tasks such as: